Welcome to The Gigacasting Newsletter

New here? Subscribe

All The Pieces At Volvo Kosice Gigacasting Plant Are Coming Together

In recent months, an increasing number of suppliers have been sharing images of their products, either installed or ready for shipment, to Volvo’s new Gigacasting Plant in Košice, Slovakia.

The Košice facility will leverage Volvo’s latest electric vehicle technology. It is slated to produce two models featuring Rear underbody Gigacastings, following Volvo’s next generation manufacturing strategy.

With mega casting, large aluminium casted parts replace in some cases, more than 100 smaller parts.

By using fewer parts we can lower our costs, reduce manufacturing complexity, improve sustainability across our supply chain and create lighter cars.

Landed cost for a mega cast structure is up to 35% below a mixed steel-aluminium structure.

Time from raw material to ready product is reduced from months to days. And the upstream value chain is replaced by raw material input directly to our plants, which gives us greater control over the costs.

Production will begin by the end of 2026 with a new Volvo model, followed by the Polestar 7, an electric SUV, in 2028. The Polestar brand is part of the Geely Group, just like Volvo.

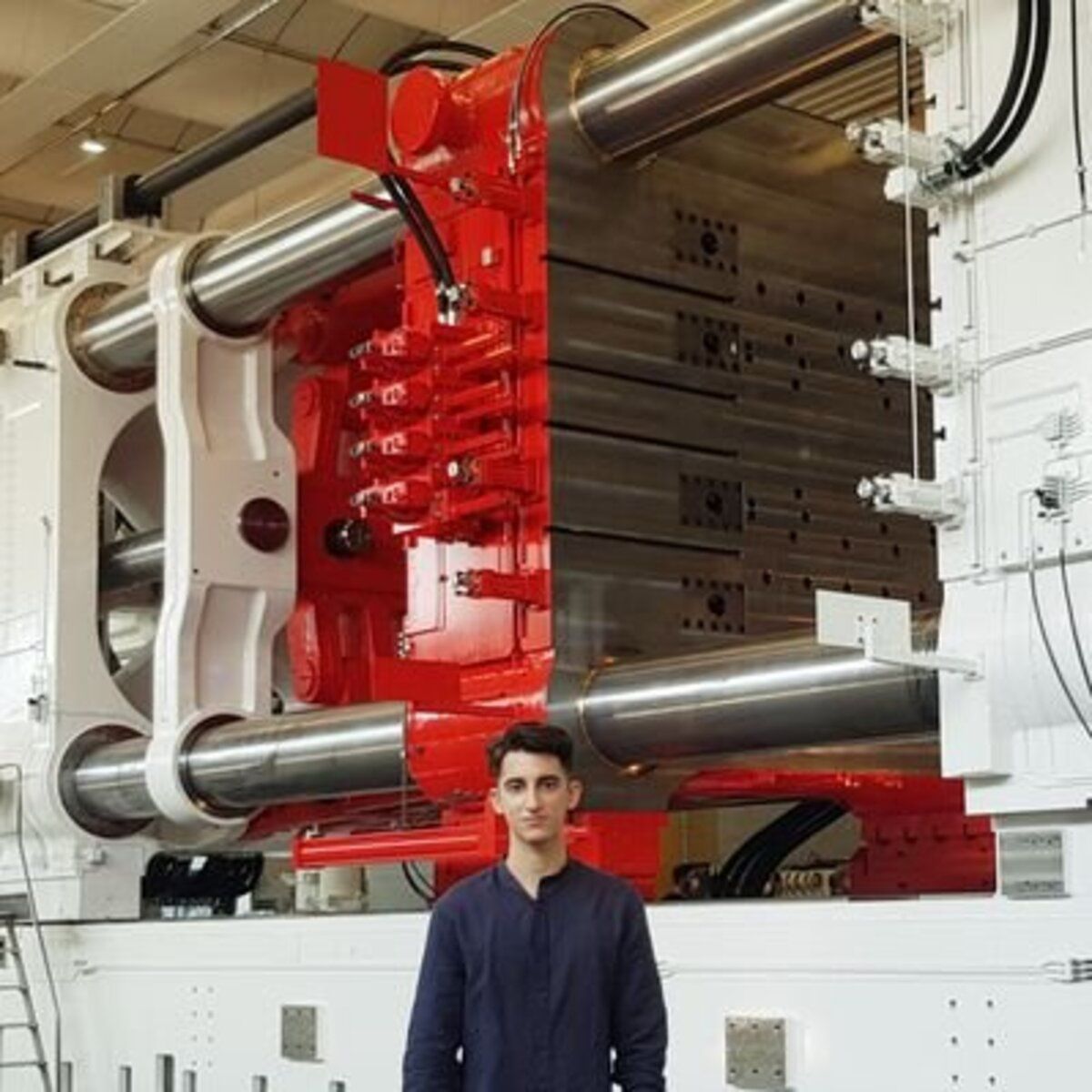

The Košice plant is equipping itself with two 9,200 ton Giga Presses, manufactured by IDRA Group in Northern Italy.

As noted earlier, the components for this Gigacasting plant are coming together, with critical equipment, such as die casting machines, furnaces, vacuum systems, and air filtration units, either ready for shipping or being installed on-site.

Our new fully-electric state-of-the art car factory in Kosice, Slovakia, will bring other new opportunities as well.

On a per-vehicle basis, it is expected to use 30% less energy in production, 40% less manufacturing waste and 40% less water usage, compared to our current operations.

It will also use 100% climate neutral energy in the manufacturing operations. Our Kosice plant will also introduce new efficiencies in painting and stamping.

All of our plants stand to gain from these advances in our manufacturing set-up as we share knowledge across our teams and strive towards our efficiency and sustainability ambitions.

We ’re proud of our global footprint and unique in-house capabilities. But we also know that collaborators win in such unpredictable times.

Dongfeng Motor’s Gigacasting Plant Enters Trial Production

Dongfeng Motor’s Gigacasting plant has entered trial production for its first phase, with the world’s largest 16,000 ton and a 10,000 ton die casting machine now operational.

The project focuses on developing, manufacturing, and supplying ultra-large Gigacasting structural components for new energy vehicles, including front and rear underbodies, battery trays for hybrids and fully electric vehicles, and potentially C-D inner side panels for Dongfeng’s various brands.

Supported by a 226 million yuan investment ($31.2 million at the time of announcement), construction began in April 2024.

Upon completion, the plant will feature six die casting production lines, rolled out in three phases. China News toured the completed factory, sharing a video showcasing the facility’s readiness for trial production.

Visible details include workers installing dies and forklifts transporting liquid aluminum to holding furnaces.

Once fully operational, the 16,000 ton and 10,000 ton machines are projected to produce a combined 200,000 units annually. When all three phases are complete, the plant’s total capacity will reach 600,000 units per year.

Mass production of the first phase is expected to be begin in June 2026.

I translated the video from China News, you can watch it here

The Refreshed Xpeng P7 Adopts New Front and Rear Gigacastings

The Xpeng P7, one of the company’s first models launched in mid 2020, underwent a significant restyling that transformed its aesthetics and manufacturing process.

The vehicle’s production shifted from a traditional stamped body to Front (FUB) and Rear UnderBody (RUB) Gigacastings, enabled by Guangdong Hongtu’s 16,000 ton die casting machine. This machine supplies Gigacastings for both the Xpeng P7+ and the updated P7.

Careful not to confuse the P7+ and P7. The P7+ is a separate model, while the P7 is the refreshed version of the old P7i.

Based on the image above we can already make some conclusions.

The P7’s Gigacasting design prioritizes manufacturing efficiency by integrating multiple components to reduce part count, even if it introduces minor weight inefficiencies in some areas.

These inefficiencies are evident in large flat surfaces, such as the rear floor and wheel arches, which are incorporated directly into the rear casting.

While using separate flat surfaces with spot-welded stamped sheets could reduce weight, it increases part numbers and manufacturing complexity. This approach suits premium vehicles, but Xpeng’s strategy aligns with affordability goals.

In its rear underbody design, unlike Tesla, Xpeng excludes integrated crash cans to improve repairability.

In a moderate speed rear collision, the crash cans of a Tesla Model Y rear casting absorb the impact and brake, potentially hindering repairability.

However, Tesla’s “Gigacast Sectioning” method, detailed in my article, enables cost effective casting repairs.

Xpeng, by contrast, uses separate crash cans, akin to traditional body-in-white (BIW) designs, for simpler repairs.

Tesla Model Y RUB

Xpeng integrated the large front wheel arches in all of its Gigacastings, but similarly to the front underbody omits crash cans. Xpeng employs varied approaches for front castings, for example; the G6 and P7+ FUBs include integrated crash cans, while the X9 and P7 do not.

G6 FUB

X9 FUB

Half Year Financial Results

Guangdong Hongtu, Gigacasting parts supplier

Guangdong Hongtu reported an operating revenue of 4.27 billion yuan ($599 million), reflecting a 17.21% year-on-year increase. The company's net profit stood at 114 million yuan ($16 million), which marked a 34.08% year-on-year decrease.

Within its segments, the die-casting business generated revenue of 3.2 billion yuan ($452 million) and achieved a net profit of 86 million yuan ($12 million).

Millison Technology, Gigacasting parts supplier

Millison achieved an operating revenue of 1.86 billion yuan ($261 million) in the first half of 2025, showing a 12.41% year-on-year growth.

However, the company recorded a net profit of -105 million yuan (-$15 million), representing a sharp 468.13% year-on-year decline.

Tuopu Group, Gigacasting parts supplier

Tuopu posted an operating revenue of 12.9 billion yuan ($1.8 billion) for the first half of 2025, with a 5.83% year-on-year increase.

The net profit was 1.295 billion yuan ($182 million), indicating an 11.08% year-on-year decrease.

Yizumi, Gigacasting and Thixomolding machine supplier

Yizumi realized an operating revenue of 2.746 billion yuan ($385 million) in the first half of 2025, up by 15.89% year-on-year.

The net profit reached 345 million yuan ($48 million), demonstrating a 15.15% year-on-year rise. Specifically, the die-casting machine business contributed revenue of 556 million yuan ($78 million), achieving a 33.29% year-on-year increase.

🎯 Reach the heart of the die casting industry with The Gigacasting Newsletter, the world’s most targeted newsletter and website for die casting professionals.

🌐 With thousands of engaged subscribers and high-impact ad placements, your business can connect directly with decision-makers and innovators in the field.

📩 Visit IndustryArsenal.com/collab to discover how The Gigacasting Newsletter can elevate your brand. Secure your spot today!

Last Article: